Build Investment Confidence Through Real Understanding

Look, the investment world throws a lot at you. Market signals, economic indicators, portfolio strategies — it's easy to feel overwhelmed. Our learning program isn't about turning you into a day trader overnight.

What we focus on is helping you understand the reasoning behind financial decisions. You'll work through real market scenarios from 2024 and early 2025, seeing how different approaches played out. Not theory from textbooks, but actual case studies that show both successes and mistakes.

We've been teaching Canadian investors since 2019, and one thing's clear: people who understand the fundamentals sleep better at night. They ask better questions. They spot opportunities others miss.

How We Approach Financial Education

Our methodology comes from years of watching what actually helps people make better investment decisions. Here's what sets our approach apart from typical online courses.

Context Over Formulas

Anyone can memorize a formula. Understanding when and why to apply it? That's different. We start every concept with real market situations, then show you the tools that address them. You'll see why diversification matters through actual portfolio examples, not just pie charts.

Question-First Learning

Instead of lecturing for hours, we pose questions you'd actually face as an investor. Should you rebalance now? How much emergency cash makes sense? You work through these scenarios with guidance, building your decision-making muscle rather than just memorizing answers.

Mistakes Included

Most courses only show success stories. We think that's backwards. You'll analyze investments that didn't pan out, portfolios that needed adjusting, and timing decisions that missed the mark. Learning what went wrong teaches you more than studying perfect examples.

Your Journey From Nervous to Informed

The program runs for nine months, starting in October 2025. That might seem long, but financial literacy isn't something you rush. Each phase builds on what came before, giving you time to absorb concepts and actually use them.

Foundation Phase

We start with market fundamentals and investment vehicles. Not boring textbook stuff — you'll look at real Canadian companies, compare stocks versus bonds using current examples, and understand what risk actually means for your personal situation. By the end, you'll read financial news and actually understand what's happening.

Months 1-3Strategy Development

Here's where it gets interesting. You'll work through portfolio construction using different risk profiles, analyze real allocation strategies, and understand rebalancing decisions. We use case studies from 2024's market conditions — both the wins and the rough patches — so you see strategies in action.

Months 4-6Applied Practice

The final phase focuses on practical application. You'll evaluate investment opportunities, spot red flags in financial products, and understand when professional advice makes sense versus when you can handle it yourself. Think of it as building your financial BS detector.

Months 7-9Who's Teaching This Program

You're not learning from talking heads reading slides. Our instructors have managed actual portfolios, weathered market downturns, and made their share of mistakes. That experience shows up in every session.

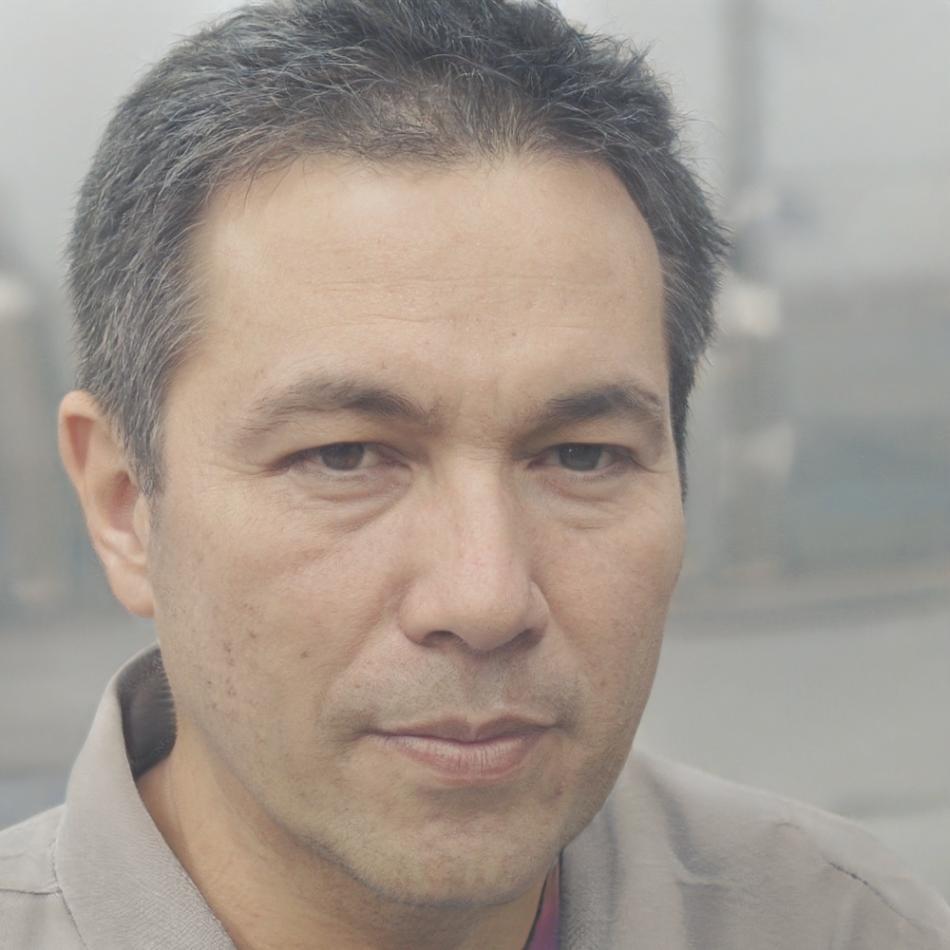

Henrik Lundqvist

Portfolio Strategy

Henrik spent fifteen years managing institutional portfolios before moving into education. He's seen three recessions, multiple bull markets, and pretty much every investment mistake possible. His teaching style is direct — no jargon unless you actually need it.

Vera Kowalski

Market Analysis

Vera worked as an equity analyst at two major Canadian banks before joining our team in 2021. She breaks down complex market movements into understandable patterns, and her real-world examples come from companies most Canadians actually know.

Declan O'Brien

Risk Management

Risk assessment is Declan's specialty. He spent a decade in portfolio risk management and now focuses on helping individual investors understand their actual risk tolerance versus what they think they can handle. The difference matters more than you'd expect.

Ready to Understand Your Investment Decisions?

Our next cohort begins October 2025, with sessions held twice weekly in the evenings. The program works for busy schedules — we know you're not quitting your job to study finance full-time.

Sessions run Tuesday and Thursday evenings from 7 PM to 9 PM Eastern, with recordings available if you miss one. You'll also get access to our case study library and analysis tools.

- 9-month comprehensive program

- Live evening sessions twice weekly

- Real market case studies

- Small group discussions